Unpacking Canada’s Fossil Fuel Subsidies

Their size, impacts, and why they must go

Fossil fuel subsidies hold us back and incentivize pollution. How much do Canada's governments subsidize fossil fuels, and why does it matter?

What are fossil fuel subsidies?

How much does Canada give out in fossil fuel subsidies?

So subsidies are expensive, and they cost me money. Is that why they are a problem?

Is the government doing anything about this?

What are common misconceptions on subsidies?

Can you tell me more about these subsidies?

Oil, gas, and coal are multi-billion-dollar industries, yet every year fossil fuel companies get billions in tax breaks and handouts that increase their profits even further. In a world that’s shifting to clean energy, Canada could get left behind if these subsidies don’t change. Fossil fuel subsidies also work against other climate change actions, incentivizing the very pollution we’re trying to stop. Canada committed to phasing out inefficient fossil fuel subsidies 11 years ago—but even after over a decade, there are still large subsidies to fossil fuel production. With COVID-19 stimulus spending, fossil fuel subsidies went up in 2020 compared to previous years.

Taxes and subsidies are a complicated topic, so we created this web page to explain federal and provincial subsidies in Canada. We’ll cut through the jargon, so you can understand what’s really happening, debate it, and propose solutions for Canadians and Canada’s economy.

What are fossil fuel subsidies?

A subsidy is a financial benefit that the government gives, usually to a specific business, group, or industry. There are debates about the difference between “subsidy” and the broader term “support,” but that’s a pretty good plain English definition. (It’s also roughly how the World Trade Organization defines the term—and their definition is globally accepted.) This financial benefit most commonly comes as a direct handout of cash or a tax break. Either way, it’s more money in the pocket of whoever receives the subsidy. Fossil fuel subsidies go to fossil fuel producers or consumers—whether it’s for extracting oil, shipping gas through a pipeline, or burning fossil fuels for energy.

How much does Canada give out in fossil fuel subsidies?

It’s difficult to know, because federal and provincial governments haven’t transparently reported how much they really provide in fossil fuel subsidies. From what we do know, it’s at least CAD 4.8 billion per year. That includes measures like special tax deductions and direct cash transfers that governments provide to fossil fuel companies. You can find a list of some of the largest subsidies below. Examples of federal subsidies include research and development support programs and tax breaks like flow-through shares, which incentivize oil, gas, and mining exploration.

Examples of provincial subsidies include crown royalty reductions in Alberta valued at an average of CAD 1.16 billion and deep drilling and infrastructure credits in British Columbia valued at CAD 350 million in 2019.

In addition to the more narrowly defined subsidies, governments also provide public finance to fossil fuels through loans, guarantees, equity, and grants. Canada is one of the largest international fossil fuel financers in the world, averaging CAD 11 billion per year from 2018 to 2020.

What do fossil fuel subsidies cost me?

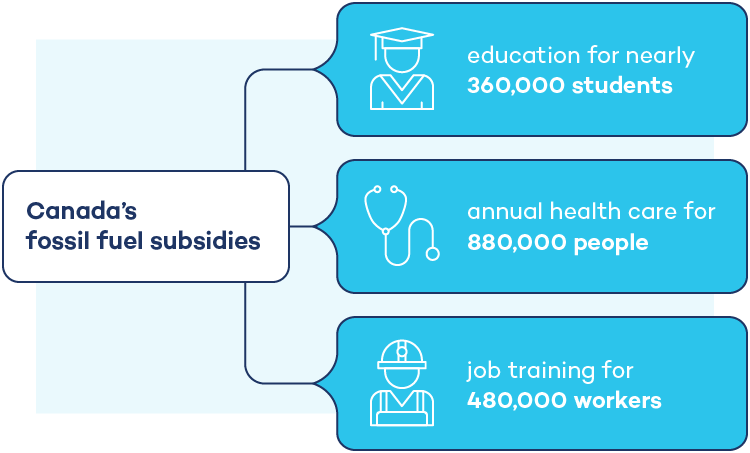

Canada’s subsidies represent a lot of money. Let’s put it in perspective.

- They would pay for education for nearly 360,000 students (Canada’s average annual spending per K–12 student is CAD 13,315).

- It would offer job training for 480,000 workers (Canada Job Grants provide up to CAD 10,000 to help workers gain the right skills).

- It would pay for annual health care costs for 880,000 people (Canada spends CAD 5,418 per person on health care each year).

Wouldn’t you rather this money be spent on issues that matter to Canadians?

So subsidies are expensive, and they cost me money. Is that why they are a problem?

Yes, but it gets worse. Fossil fuel subsidies also undermine the other climate change actions that Canada is taking. For example, the federal government recently introduced carbon pricing across Canada. By making carbon pollution more expensive, carbon pricing encourages us to pollute less. Just like Canada’s past success in stopping acid rain, putting a price on carbon pollution is a key part of the global fight against climate change. But through money and tax breaks, fossil fuel subsidies increase the same pollution that we’re trying to lower. Rather than making pollution expensive, they make it cheaper. This is like raising taxes on cigarettes to discourage smoking while also giving tobacco companies tax breaks so they can make more cigarettes and profits.

To make matters worse, fossil fuel subsidies disadvantage clean energy because they make it cheaper to produce or burn fossil energy. When fossil fuels are artificially cheap, investing in renewable energy becomes less attractive. In the long run, subsidies distort the market, pushing investment toward sectors that might not otherwise be viable. If even a small portion of subsidy savings were swapped to support renewable energy or energy efficiency, we could make a faster shift to an economically stable, climate-safe future. That sounds like a pretty good alternative compared to getting locked into dangerous climate change and unhealthy pollution!

Is the government doing anything about this?

In short: despite commitments for reform, progress is slow. At the provincial level, there have been very few efforts to reform subsidies. At the federal level, Canada committed to phasing out “inefficient” fossil fuel subsidies way back in 2009, as part of the G20. In 2021, they moved up their deadline to complete this to 2023.

However, Canada still hasn’t taken all the necessary steps to live up to these promises and has added new subsidies in the wake of COVID-19. In a scorecard ranking G20 countries’ support to fossil fuels (including subsidies and other policies like public finance), Canada ranked last among 11 OECD countries on progress in ending support to fossil fuels.

Canada is also lagging on public finance commitments. As one of the biggest financiers of fossil fuels internationally through Export Development Canada, the country is not yet on track to meet its Glasgow commitment to phase out this international financing by the end of 2022.

As part of its G20 commitment, the federal government is doing what’s called a “peer review” with Argentina. Through this process, Canada is evaluating “inefficient” federal fossil fuel subsidies. Overall, the process isn’t entirely clear and is well behind schedule. Where other reviews took 12–18 months, Canada and Argentina are now in their fourth year. We also don’t know which subsidies will or won’t be considered inefficient, or even which subsidies will be reviewed. IISD is following the peer review process and will keep our readers updated as it progresses.

The federal government has made moves to reform certain tax deductions that act as subsidies to fossil fuel companies. But with the 2023 commitment, the government still has a lot of work to do—and fast.

What should Canada do?

To start, the federal and provincial governments should stop introducing new subsidies for fossil fuel companies. At the same time, governments shouldn’t be extending the lifespan of any existing subsidies that are scheduled to expire. It’s also important that all government spending have clear conditions and standards to align spending with climate change goals.

As well, governments should be upfront with Canadians about how much money they spend on fossil fuel subsidies each year. This means increasing transparency and measuring subsidies using globally agreed-upon definitions and methodologies.

What are common misconceptions about subsidies?

There are a number of misconceptions about subsidies that seek to exclude certain types, argue for estimation methods that minimize their size, or mislead on the goals of fossil fuel subsidy reform. These efforts to push policy-makers away from international guidelines and best practices have delayed fossil fuel subsidy reform in Canada. Here, we clarify some common misconceptions about fossil fuel subsidies in Canada:

Misconception: Money to reduce greenhouse gas emissions is not a subsidy. Grants and direct spending that have environmental benefits are not subsidies.

Correction: Ultimately, these help fossil fuel industries compete and lower their cost of business, so they are correctly classified as subsidies. There can be a significant opportunity cost when government directs money to this type of subsidy rather than other clean energy or emission-reduction options. Grants and direct spending clearly fall within the World Trade Organization’s definition of subsidies.

Misconception: Tax expenditures and royalty relief are not subsidies. Allowing companies to undervalue their assets for tax purposes just levels the playing field for capital-intensive industries.

Correction: Tax expenditures and royalty relief have the same impact as grants. They reduce government revenue while lowering the cost of producing fossil fuels, giving them an unfair advantage when countries need to be rapidly transitioning to renewables. They also clearly fall within the World Trade Organization definition of subsidies as “government revenue forgone or not collected.” They are included in internationally recognized subsidy methodologies.

Misconception: Canada has already reformed all of its “inefficient” fossil fuel subsidies.

Correction: Canada has reformed only a handful of tax measures and argues that those that remain are either not subsidies (see above) or are not inefficient. But Canada hasn’t given a robust definition of “inefficient,” making it difficult to hold them to their own commitment. In 2019, the Office of the Auditor General found that Canada’s assessment of inefficient subsidies for fossil fuels was incomplete and didn’t take into account the environmental or social costs of subsidies.

IISD has proposed four criteria that the Canadian government should use to identify inefficient fossil fuel subsidies, ensuring that they adopt a strong definition that doesn’t leave any loopholes for problematic subsidies to continue. This includes ensuring public funds are spent in ways that are: (1) aligned with Canada’s climate commitments; (2) supportive of a low-carbon economy; (3) consistent with a just transition; and (4) the best way to achieve the policy’s goal. Through this lens, it becomes apparent that there is essentially no room for fossil fuel subsidies in the context of Canada’s commitment to phase out inefficient subsidies by 2023.

Misconception: All subsidies are inherently bad.

Correction: When properly applied, subsidies can support the low-carbon transition and avoid bankruptcies and unemployment risks. For example, careful government spending can support worker transitions from fossil fuels to clean energy while encouraging a shift away from the production and consumption of fossil fuels.

Misconception: Removing fossil fuel subsidies means advocating for job losses and energy insecurity.

Correction: Fossil fuel subsidy reform can be done in a way that supports job creation and enhances energy security, setting Canada up to thrive in a low-carbon economy. For example, ensuring affordable energy access in remote and northern communities in Canada is an absolute necessity. Historically, some fossil fuel subsidies have enabled this. However, a subsidy should only remain in place if it verifiably meets robust criteria for inefficiency, with a plan for eventual phase-out. IISD supports developing alternative policies that encourage clean energy options while maintaining affordable access.

To learn more, you can check out our report on applying best practices for fossil fuel subsidy measurement in Canada.

Can you tell me more about these subsidies?

Here are some of the largest current subsidies in Canada.

| Subsidy name | Who gives it? | Who gets it? | How much is it worth?* |

|---|---|---|---|

| LNG Canada investment | Canada | LNG Canada | $275 million |

| Direct spending & budgetary transfers** | Canada | Oil and gas companies | $318 million |

| Crown royalty reductions | Alberta | Oil and gas companies | $1.136 billion |

| Tax exemptions for certain fuels & uses in industry | Alberta | Industry | $287 million |

| Royalty reductions, including deep drilling and infrastructure credits† | British Columbia | Oil and gas companies | $631 million |

| Reduced tax for aviation fuel†† | Ontario | Aviation Industry | $273.5 million |

| Tax exemption for coloured fuels used in agriculture | Ontario | Agricultural industry | $275 million |

| Fuel tax exemptions and reductions | Quebec | Industry and other consumers | $303.5 million |

* The exact amount changes from year to year, so unless otherwise listed, this is a yearly average based on OECD estimates from the period 2016–2019, with specific data used for all years available and averaged. During periods of higher oil prices, royalty payments will also tend to be higher.

**From fiscal year 2019/20. For a full breakdown, see our most recent federal subsidy report.

† From fiscal year 2018/19, as listed in British Columbia’s Public Accounts.

†† Data from Ontario’s Taxation Transparency Reports.

The IISD Global Subsidies Initiative has produced a wealth of information on subsidies to fossil fuels globally and in Canada.

You can learn more from this detailed report, which gives a breakdown of fossil fuel subsidies by Canada’s federal government in 2020.

If you’re curious about provincial and territorial subsidies, you can check out reports we’ve done on Alberta, British Columbia, Newfoundland and Labrador, Nunavut, Ontario, Quebec, and Saskatchewan.

This article was last updated in August 2022.

You might also be interested in

Canada's Federal Fossil Fuel Subsidies in 2020

Federal fossil fuel subsidies in Canada reached at least CAD 600 million in 2019, but more transparency is needed from government to understand the full picture.

International Best Practices: Estimating tax subsidies for fossil fuels in Canada

This report outlines international best practices in defining and estimating tax subsidies and other types of foregone government revenue.

The (Public) Cost of Pollution: Ontario's fossil fuel subsidies

This report provides an inventory of fossil fuel subsidies in Ontario and provides recommendations for provincial subsidy reform.

Locked In and Losing Out: British Columbia’s fossil fuel subsidies

British Columbia's fossil fuel subsidies reached CAD 830 million in 2017–2018, and new subsidies continue to be introduced. This report identifies provincial subsidies and calls on the province to undertake subsidy reform.