Working with Countries to Move Beyond GDP

In his recent policy brief, Valuing What Counts: Framework to Progress Beyond Gross Domestic Product, the UN Secretary-General invites member states to move beyond GDP by measuring what truly matters for sustainability and prosperity. The policy brief outlines the shortcomings of GDP as an indicator and suggests more meaningful measures.

Some of the points stressed in the brief reinforce the conclusions of IISD’s work on expanded wealth measures to complement GDP in three countries—Indonesia, Ethiopia, and Trinidad and Tobago. IISD is working closely with economic experts and researchers from universities in each of the three countries to develop expanded wealth measures to complement GDP. Our work reflects and reinforces the Secretary-General’s call to complement GDP in several ways.

First, the UN policy brief stresses the need for a concise, widely accepted, comparable, and universally applicable (p. 10) framework to complement GDP. The expanded wealth framework IISD applies in our work is just that. Based on the global comprehensive/inclusive wealth frameworks developed by the World Bank and the UN Environment Programme, this robust framework complements GDP by measuring the assets that underpin well-being in all its forms: economic, environmental, and social. Our country partners understand the utility of the framework and are working with us to implement it using country data and expertise. We have modified the global methods used by the World Bank in ways that will ensure comparability and universal applicability—for example, by simplifying the approach to measuring human capital and produced capital.

The three coutries are using a simplified method of estimating the value of produced assets. This method builds on guidance for measuring capital stocks from the Organisation for Economic Co-operation and Development (OECD) and uses basic data on fixed capital formation available in essentially all countries. As such, it effectively leverages what already exists. Data for fixed capital formation in major economic sectors were readily available in all three countries for at least a 20-year time horizon. Using OECD methodological guidance, these data were readily converted to the time series of stock values required to measure wealth.

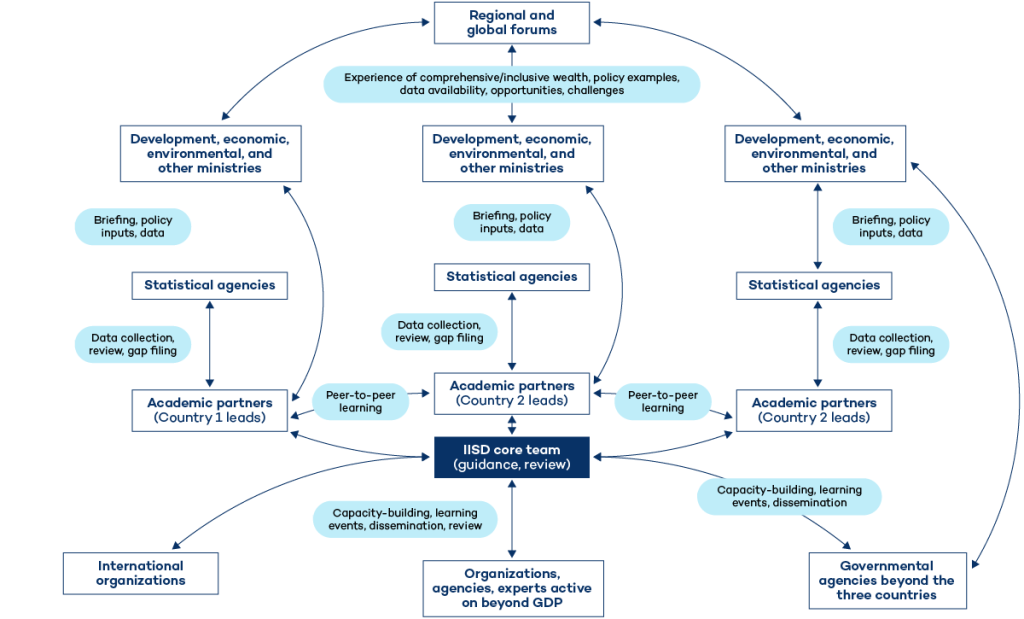

Second, the Secretary-General emphasizes that any framework to measure beyond GDP must be country owned (p. 10). Our wealth framework is being applied in three countries with very different development priorities, challenges, and data availability. Nevertheless, robust estimates have been produced for all three countries by national experts using national data. The results reveal useful insights in each. To help build country ownership, IISD provides guidance and quality control while leaving the estimation work to country experts. These experts are responsible for liaising with national statistical offices, central banks, and other data providers to collect data, calculate indices, prepare reports, and consult on policy recommendations. The IISD team provides support and arranges peer-support meetings between the country experts. The approach has been strongly collaborative from the start, with the goal of ensuring country ownership of the methods and results in the end.

Third, the Secretary-General suggests that measuring beyond GDP should be “iterative and dynamic, based on what exists, while allowing for the addition of new indicators” (p. 10). By building upon the World Bank’s and UN Environment Programme’s efforts to measure expanded wealth indicators, IISD is already applying this guidance in its efforts to go beyond GDP.

Finally, the Secretary-General also stresses that any framework intended to complement GDP should convey strong and clear messages that are actionable and intuitive (p. 10). IISD’s collaborative approach to building expanded wealth measures provides useful insights for the countries involved. It helps them build the capacity that will inevitably be needed if countries are to move beyond GDP. Our experience shows that data collection, estimation, and interpretation will consist of a multi-year effort.

While it is important to understand the concepts and rationale for this work, many of the specific challenges in national application only become evident through “doing.” IISD’s engagement with country partners has, so far, lasted 4 years and involved more than 14,000 hours of technical support. Our experience shows that with support, countries can produce expanded wealth measures. Over time, countries will be able to produce this data on their own—just as they do for GDP. But reaching that goal will require targeted long-term support and guidance so countries can gain the experience they need.

You might also be interested in

Human Capital in Ethiopia, Indonesia, and Trinidad and Tobago

Human capital is the major component of comprehensive wealth in most countries, and how it is managed is key to long-term prosperity.

Produced Capital in Ethiopia, Indonesia, and Trinidad and Tobago

Part of comprehensive wealth, produced capital is the value of the stock of all human-made assets used to produce goods and services in the economy.

Financial Capital in Ethiopia, Indonesia, and Trinidad and Tobago

Like other assets of the comprehensive wealth portfolio, financial capital can be used to support a country's long-term prosperity.

Natural Capital in Ethiopia, Indonesia, and Trinidad and Tobago

Natural resources play fundamental roles in our well-being and lives, as well as sustaining a country's comprehensive wealth.